FREQUENTLY ASKED QUESTIONS

Investor FAQs:

A private loan is a type of loan that is collateralized by real estate. They are typically used by borrowers who cannot qualify for traditional bank loans or need quick access to funds. These loans factor in primarily the valule of the collateral and Borrower track record, as Opposed to metrics like credit score Etc..

Private notes typically yield approximately 10%, providing investors with the potential for higher returns than traditional public investments or Treasury notes.

Investors can expect to receive automatic ACH distributions each month or quarter depending on the deal.

Our experienced legal team conducts top-tier due diligence, ensuring that all loans are vetted to the highest standards. We also prioritize automation to ensure a streamlined and secure investment process.

Private loans are backed by strong collateral in the form of real estate with low LTV ratios. In the event that the borrower defaults on the loan, the lender has the right to foreclose on the property and recoup their investment.

Borrower FAQs:

We offer funding for a variety of property types, including single-family homes, multi-family properties, and commercial real estate.

Our loans typically have a maximum LTV ratio of 70%, depending on the specific terms of the loan.

Our streamlined process ensures that you can receive funding quickly. Depending on the specifics of the loan, funding can be received in as little as a few days.

Interest rates on private loans vary depending on the specifics of the loan, including the type of property, the loan amount, and the borrower’s creditworthiness.

We do not have a specific minimum credit score requirement. Instead, we evaluate borrowers based on their overall financial situation, including their ability to repay the loan.

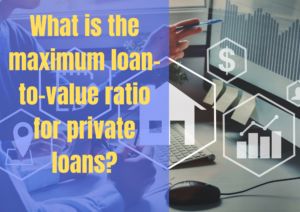

States we serve